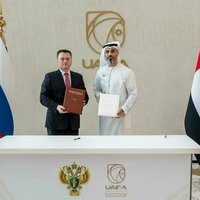

ABU DHABI, 16th April 2025 (WAM) -- The UAE Ministry of Finance has announced the issuance of Ministerial Decision No. (88) of 2025, adopting all guidance issued by the Organisation for Economic Co-operation and Development (OECD) on Global Anti-Base Erosion (GloBE) Rules (Pillar Two).

This decision follows the issuance of Cabinet Decision No. (142) of 2024 regarding the imposition of a Top-up Tax on Multinational Enterprises.

This decision reaffirms the UAE's continued commitment to applying international standards and best practices in the field of taxation, in line with the OECD Inclusive Framework on Base Erosion and Profit Shifting (BEPS), of which the UAE is a member.

The Ministry clarified that the adoption of the new decision includes all Administrative Guidance and relevant commentary issued by the OECD up to January 2025. This ensures that the UAE's Domestic Minimum Top-up Tax (DMTT) framework remains consistent and is aligned with the OECD GloBE Model Rules, thus further minimising the compliance burden for in-scope Multinational Enterprises.