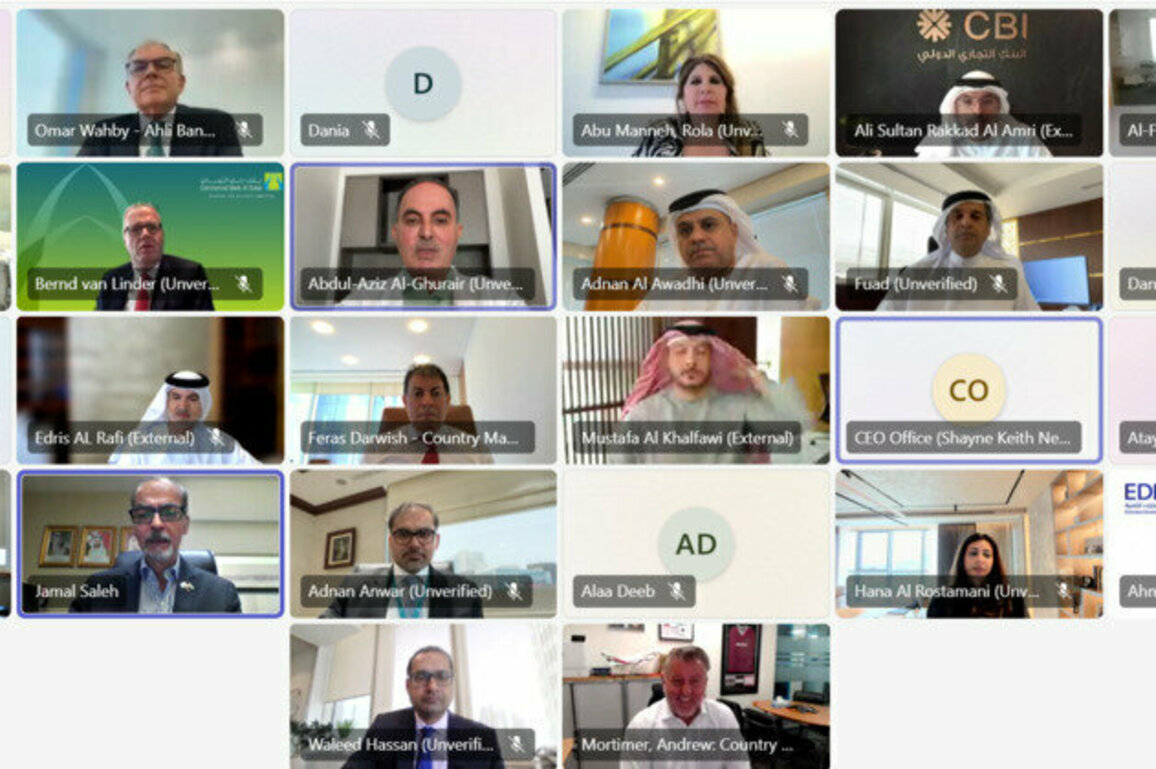

ABU DHABI, 17th April, 2025 (WAM) -- The CEOs Advisory Council of the UAE Banks Federation (UBF), the sole representative and unified voice of UAE banks, held its meeting chaired by Abdulaziz Al-Ghurair, Chairman of UBF, to review the banking and financial sector's performance during 2024, and discuss developments, initiatives and plans in 2025.

The CEOs Advisory Council praised the strong performance and achievements of the banking sector during 2024, guided by the Central Bank of the UAE (CBUAE), which is leading the sector's efforts to support the national economy's growth by establishing the necessary frameworks to ensure financial stability, strengthen monetary and regulatory legislation, and upgrade the financial, banking and insurance sectors.

Al Ghurair said that the banking and financial sector continues to develop and consolidate its leading position as the largest sector in the Middle East in terms of total assets, which increased by 12 percent over the past year to AED4.56 trillion. This reflects the CBUAE's effectiveness in supporting the growth of the banking and financial sector to drive economic and social development and cement the UAE's position as a global financial and banking centre.

He added, "We are proud of the ability of UAE banks to register remarkable growth in promoting Emiratisation, as financial and banking institutions exceeded the set targets by achieving growth of 152.9 percent, employing 2,866 Emiratis during 2024, reaffirming that Emiratisation is a top priority for us."

Al Ghurair emphasised the banking sector's commitment to achieving the strategic objectives of the UAE. He praised the efforts of the CEOs Advisory Council, which includes banking leaders with extensive experience and knowledge, to support decision-making in UBF, which focuses on ensuring a seamless and secure banking experience for customers.

During the meeting, the CEOs Advisory Council discussed UBF's plans in 2025 to develop the banking and financial sector and maintain its leading position, stressing the importance of continuing efforts and initiatives to support Emiratisation, sustainability, governance, financial inclusion and support of small and medium-sized enterprises (SMEs), in line with the directives of the CBUAE.

The meeting also discussed the latest developments and initiatives to keep pace with the accelerated developments in the global economy, digital transformation, digital infrastructure development plans, enhancing cybersecurity, raising awareness about financial crimes and advanced fraud methods and ways to combat them. It also emphasised the importance of doubling efforts to ensure compliance with laws, regulations, supervisory and supervisory guidelines and following the highest governance standards, transparency, and risk management.

Jamal Saleh, Director-General of UBF, said, "The continued strong performance of the banking and financial sector confirms the distinguished position of the UAE as an economic power and a financial and banking centre, under the direct supervision of the CBUAE's, which sets the appropriate frameworks for the banking sector to play its role in economic and social development and provide a seamless and secure banking experience that meets the requirements and aspirations of customers."

He added that the UBF remains committed to ensure continuous development and highest standards of compliance with regulations and policies to maintain an advanced banking system characterised by strength, resilience, and ability to keep pace with changes and developments in the global economy.